Downtown Shreveport is coming back.

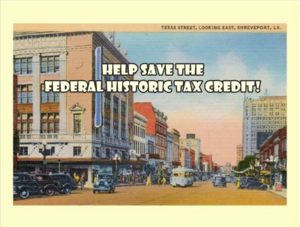

Beautiful historic buildings are being  rehabbed into apartments, condos, businesses and offices. The cost of rehabbing century-old structures, many with deferred maintenance, is high, and the numbers sometimes will only work with the assistance of the Federal Historic Tax Credit (HTC), begun by President Ronald Reagan.

rehabbed into apartments, condos, businesses and offices. The cost of rehabbing century-old structures, many with deferred maintenance, is high, and the numbers sometimes will only work with the assistance of the Federal Historic Tax Credit (HTC), begun by President Ronald Reagan.

This credit is now being threatened and we need your help to save it and to help save more of our historic places.

The just-released House Tax Reform bill has eliminated the HTC.

We know that the Historic Tax Credit has a proven track record of creating jobs, spurring private investment, and generating fiscal revenue. While the Tax Reform bill is intended to stimulate economic growth, elimination of the federal historic tax credits undermines the revitalization of our older and historic towns and cities. This includes Shreveport, Monroe, Alexandria, and Natchitoches, all cities that have seen rehabs due in part to HTC.

We know that the Historic Tax Credit has a proven track record of creating jobs, spurring private investment, and generating fiscal revenue. While the Tax Reform bill is intended to stimulate economic growth, elimination of the federal historic tax credits undermines the revitalization of our older and historic towns and cities. This includes Shreveport, Monroe, Alexandria, and Natchitoches, all cities that have seen rehabs due in part to HTC.

Congress will begin debate on this bill next week with a vote expected by mid-November. The Senate tax reform bill is expected to be released before Thanksgiving.

Please ACT NOW to communicate the value of the Historic Tax Credit to our Representatives and Senators in Congress.

How can you take action right now? Contact House and Senate Members!

- Call during office hours.

- Ask to speak to tax staff or ask for a tax staffers email address.

A suggested outline of your email message or phone call:

- Introduce yourself as a constituent.

- Say “I heard the historic tax credit is eliminated in the House version of the tax reform bill. I am extremely concerned that this important community redevelopment incentive will no longer be available to revitalize our towns and cities and preserve our heritage.”

- Explain why you value Historic Tax Credits. Include examples from Shreveport or your area. In Shreveport, HTC has assisted in bringing the Ogilvie Hardware Building, the old Sears building and two adjacent buildings, the old Crystal Oil Building, and the old United Mercantile Building back to life. Others downtown will depend on this credit in order to be rehabbed.

- Ask…. “As tax reform moves forward, will (the Representative) stand up for the Historic Tax Credit and use his/her voice to insist that the credit be retained in tax reform?”

- Share with the office the video of President Reagan supporting the HTC.

Thank you for acting quickly in support of our downtowns!