Taking Advantage of a Grand New Opportunity (Zone)

Death now…or later?

Hang with me for a little, because we’re going to be talking math. Math is one of those things like speaking Klingon. Either you have the knack or you don’t, and one wrong inflection can mean the difference between ‘Please don’t kill me right this moment,’ or ‘Please don’t make it a lingering death.’ (Klingons are a pretty hostile lot.)

In 2017, Congress passed a new tax bill called the Tax Cuts and Jobs Act. It was a major change in the way business is done, and CPAs, tax preparers and the Internal Revenue Service are still trying  to both figure it out and implement it. There is a lot buried within the sweeping legislation, but something that can be a special benefit to Shreveport and our historic downtown is a program called the Opportunity Zone.

to both figure it out and implement it. There is a lot buried within the sweeping legislation, but something that can be a special benefit to Shreveport and our historic downtown is a program called the Opportunity Zone.

I am not a tax specialist, but I did stay at a Holiday Inn Express recently and feel marginally confident that I can give you at least an idea of the opportunities these Opportunity Zones create.  Though I’ll be focusing on downtown Shreveport, everything I describe applies to every Opportunity Zone. Over the years, I have worked with investors and developers looking for ways to make money. I do not have a problem with this, especially if in making money they restore and reopen old buildings, help create businesses and jobs and imbue downtown with more fun, excitement and vibrancy. Examples are the differences that the

Though I’ll be focusing on downtown Shreveport, everything I describe applies to every Opportunity Zone. Over the years, I have worked with investors and developers looking for ways to make money. I do not have a problem with this, especially if in making money they restore and reopen old buildings, help create businesses and jobs and imbue downtown with more fun, excitement and vibrancy. Examples are the differences that the  Lofts at 624 with its street-front Rhino Coffee have made to the 600 block of Texas Street and the foot traffic created a block away with new retail options and The Missing Link restaurant.

Lofts at 624 with its street-front Rhino Coffee have made to the 600 block of Texas Street and the foot traffic created a block away with new retail options and The Missing Link restaurant.

Developers were responsible for all of this, and these are the types of changes we want to see. The problem with development is that it can be a risky proposition and developers, investors and bankers are generally risk-averse. For obvious reasons, they want to be reasonably assured that they will make money if they spend money, and in many areas, such assurances are hard to come by. That is where the Opportunity Zones step in, in a most creative way. There are five Opportunity Zones in Shreveport; one covers the greater part of our downtown.

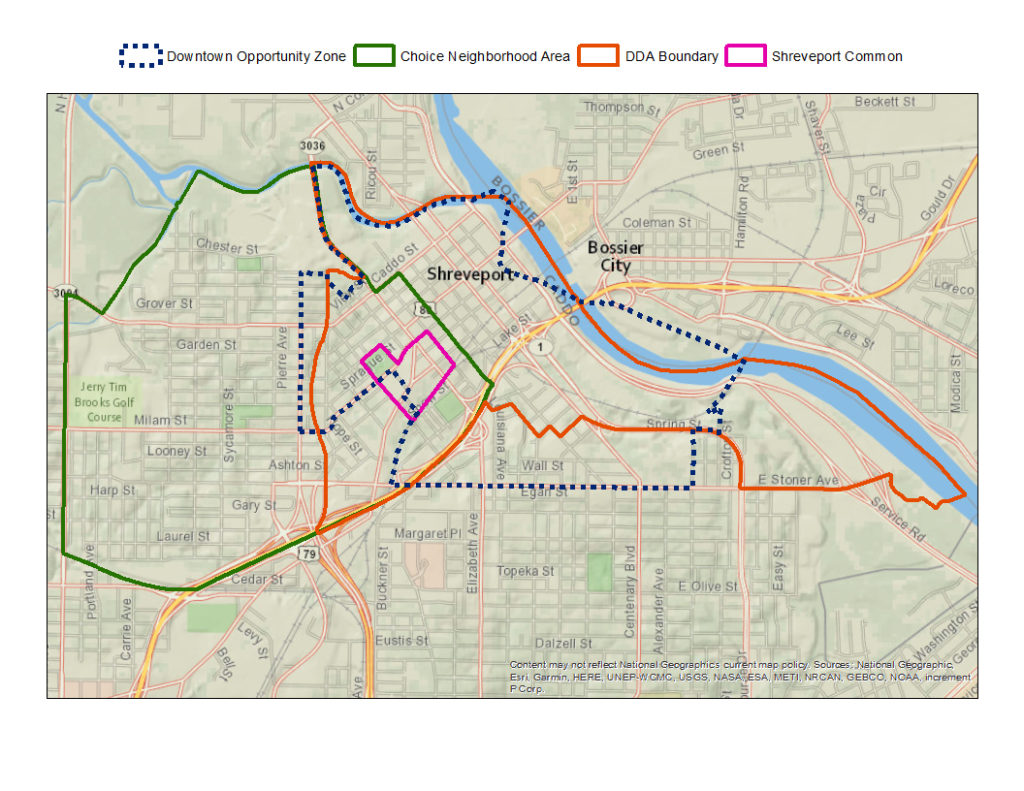

Downtown Opportunity Zone Overlay

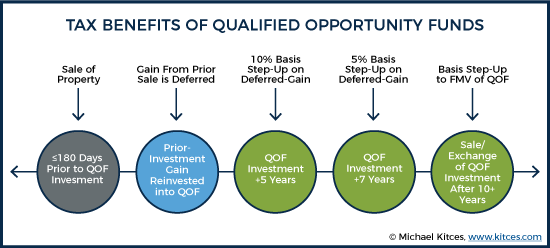

They work like this. Let’s say you sold a building or some stock and did really well. You’re happy and so is Uncle Sam, because he’s going to be sending you a sizable tax bill on those capital gains. There are ways to mitigate the tax burden of the gains- like moving to a lower tax bracket state- but the Opportunity Zone doesn’t force you to do something that drastic. What it does is lessen the tax burden while creating investment and businesses in areas that need it. Here’s the nutshell version. You make money (capital gains) on an investment.

Within 180 days, you use those capital gains to purchase an existing building or construct one in an Opportunity Zone. By doing so, you can defer paying taxes on your original gain for up to eight years. If you hold the property for seven years, 15% of your original gain could be excluded from taxes forever. If you hold the property for ten years, any gain you make on that property is excluded from taxes. What?! This is major, folks, AND it helps communities. Investments in Qualified Opportunity Funds (QOFs) in Opportunity Zones can’t just be to buy or build something and then sit on it and wait for the price to rise. We have enough of that foolishness going on already. To realize the benefits, investors will have to substantially improve the property, and at least 50% of the gross income from the business in the property will have to come from the active conduct of trade or business. These requirements that encourage investors to do well by doing good could mean big things to downtown Shreveport and other Opportunity Zones. I have just scratched the surface of both the possibilities of these zones and how the program works, but one thing is certain- this is a limited time offer on the part of the government, who is, of course, always here to help. Give it some study and give us a call. I promise we can help you find the perfect downtown spot for your next opportunity.

Want more information on Opportunity Zones? Of course you do!

This Forbes article is the best I have read.

Here is your link to 15 different resources.

Don’t forget that many Opportunity Zone properties in Downtown Shreveport could also quality for Federal and State Historic Tax Credits. Ask us about this!