How is the City of Shreveport doing? That’s a big topic, and the answers depends on who you ask. In terms of how the city is doing financially, a lot of questions were answered with publicly accessible (though sometimes hard to get) data, and graphics compiled by an Asheville, North Carolina company called Urban3 this week.

Urban3’s website promises to ‘make the complex human. We demystify tax codes, government jargon, and municipal finance data, allowing communities to clearly understand the economic impact of development.’ This week in Shreveport, they did all that.

Joe Minicozzi of Urban3 gave nearly a dozen talks while in the city to city department heads, the city council, and to the public. His talk on Monday night at LSUS should be must see TV/Click here to view the presentation. Truly, we encourage you to spend an hour and watch it. The data tells the story of what we are seeing in our city and why we are seeing it. It may answer many of the questions you have had.

We pulled just a few of the slides to show you in encouraging you to watch the entire presentation.

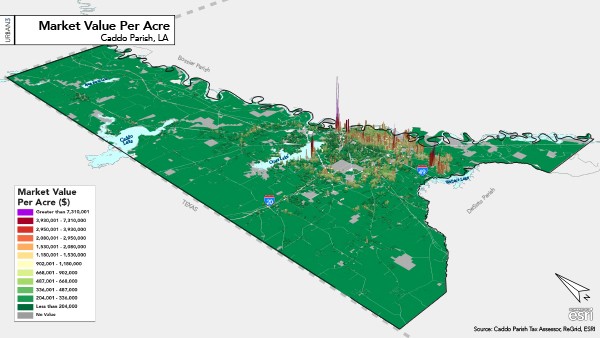

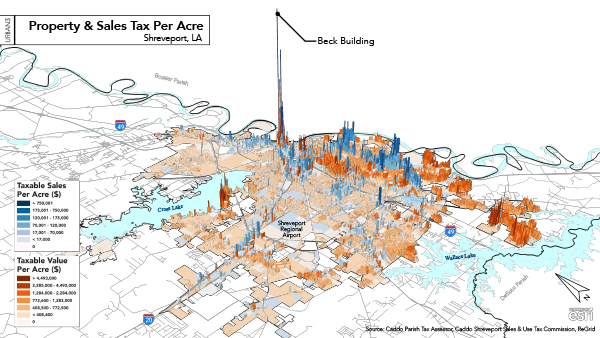

Minicozzi’s team spent months pulling data to determine the market Value per Acre of property in the City of Shreveport. This value is based on property and sales tax revenues from each parcel.

You can see there are some shining stars, the brightest of which is downtown Shreveport. There is a reason for that. Many of the buildings downtown are commercial buildings that house for profit businesses. The buildings downtown are relatively dense in number and have small footprints. They go up, instead of out. Because of that, they also use less city infrastructure like streets, water lines, and sewer lines. That factor, however, does not play into the value per acre but should be considered when making decisions.

Minicozzi used a number of slides to illustrate downtown’s value to the city as a whole (taxes paid in downtown go into the city’s General Fund that pay for everything for everyone). A Wal-Mart sitting on a multi-acre tract of land has a value of $500,000 per acre. See what these buildings downtown return for the same acre of land.

This slide is relatively mind-blowing. The smallish building at 710 Spring Street is worth vastly more per acre than Mall St. Vincent, yet look at the footprints of both. 700 Spring is the small white dot on the left.

Minicozzi warned that the number of nontaxable properties in downtown Shreveport is abnormally high. Nontaxable include all properties not paying taxes.

Minicozzi also spent considerable time talking about concerns- about Redlining, a process created in the 1930s as part of the New Deal and used by banks to deny loans to immigrants and Blacks, which was not ended until the passage of the Fair Housing Act of 1968, about the thousands of miles of streets, water and sewer lines, and additional infrastructure the city needs to maintain in the face of a declining population, about Shreveport’s large amount of vacant property, and about the property that is currently off the tax rolls, creating additional burden in the city being able to continue to pay the bills.

No, it was not all happy news, but no one thought it would be. There is reason to be encouraged, though. Now we have the data, we know what it says and can map out what comes next. Our opportunity now is to use it to make our downtown and our city more resilient and ready for the future.

Watch Minicozzi’s full talk here.