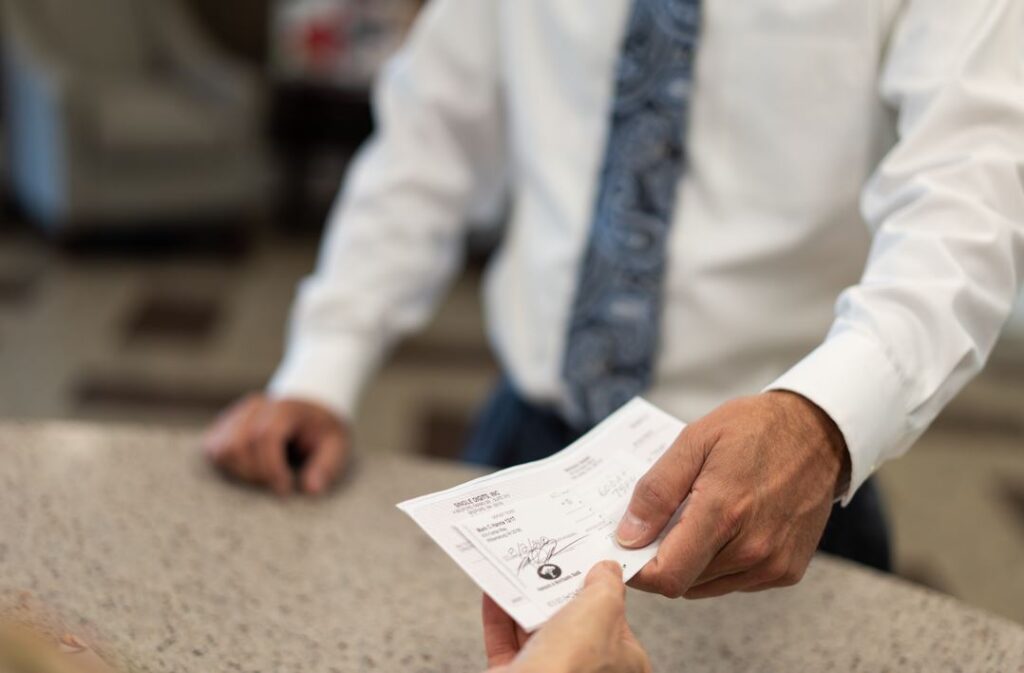

Businesses, beware. Local banks say check fraud is exploding and economic losses are climbing because of it.

Two weeks ago, the Downtown Development Authority was alerted to two counterfeit checks drawn on our account. A third counterfeit check that was stopped drew our attention to the other two.

These checks were not DDA-issued and bore counterfeit signatures, but they had correct bank, routing and transit numbers that allowed them to move through the system.

Our bank, Citizen’s National Bank at 333 Marshall Street, was quick to refund and respond. They contacted Bossier Police Department (the checks were cashed in Bossier City) and filed a report. When we met to talk about ways to secure our accounts, we discovered just how large an issue this has become- and how businesses are losing significant money because of it.

Melinda (center) and her helpful staff at Citizen’s National Bank, 330 Marshall St.

“I personally know of businesses that are being compromised,” Melinda Schimberg, Citizens National Bank VP and Downtown Branch Executive, told us. “It is happening almost every day.”

There are ways to protect your business. Here are some things you should know. (This applies to all bank customers, not just businesses.)

- Checks are dangerous. The information found on both business and personal checks can allow thieves the opportunity to counterfeit.

- Business accounts have only 24 hours to report check fraud when using ACH and 30 days for paper checks. (Personal account holders have 30 days from date of statement). If you are outside this window, your money will not be refunded.

To combat this, businesses or entities that use physical checks need to monitor their accounts DAILY to see what checks have cleared.

“Things really started to explode about two years ago,” says Schimberg. “That is when we (Citizens National Bank) started really encouraging businesses to enroll in Positive Pay.” Positive Pay is a program that allows the business to work with the bank to pre-filter checks and payments. Unapproved checks will not get through.

Schimberg says there are ways to limit your exposure to fraud. “Do as much of your banking as you can electronically to limit your exposure to paper checks. Paper checks can be lost, they can be stolen from mailboxes, they can fall into the wrong hands very easily.”

Other tips to prevent exposure:

- Direct Deposit your payroll. For employees who don’t have bank accounts, the bank can issue ‘Payroll Cards.’

- Limit debit cards. You can lose everything in a matter of minutes if your debit card or information falls into the wrong hands.

- Know that ATMS can be compromised. Local banks are finding both skimmers (that can read your debit card) and cameras (that can see the numbers you punch on the pad) installed in local ATMS. Most banks are checking their ATMs weekly (and more often) to remove these items.

- Report any counterfeit/fraud to police.

The big takeaway- check your account every day, whether you are a business or individual.

Look, it’s a jungle out there and there are a lot of people who want to get their hands onto your hard-earned money. It’s up to you to make it as hard as possible for them to do it!